.jpeg)

The evolution of wireless technologies across the globe, the buzz around 5G, and the increasing adoption of connected and intelligent devices are some of the factors driving the IoT cloud platform market.

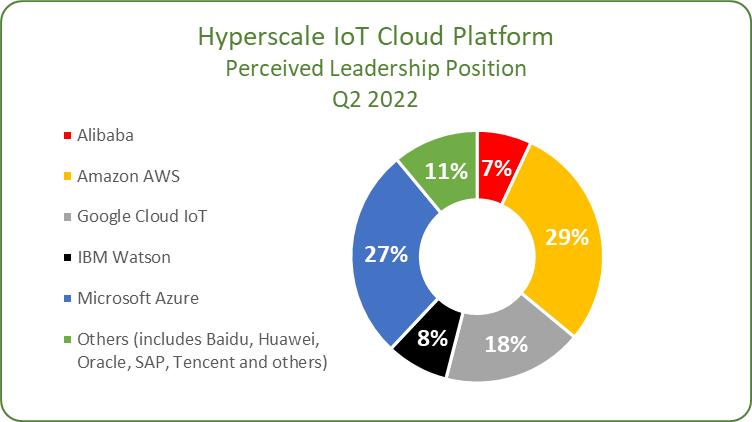

When it comes to IoT leadership, hyperscalers are not only driving market perception, but are also beginning to drive market adoption. Google, Microsoft, IBM and Amazon – the big cloud players – are playing an increasingly larger role in the accelerated growth of the IoT industry. Not a month goes by when there isn’t an announcement of further encroachment by the cloud hyperscalers into what might once have been considered MNO territory – connectivity. Not a day goes by without an announcement from the greater IoT ecosystem highlighting another marketing tie-up or joint product with a hyperscaler.

Smaller IoT platform vendors need to pay careful attention to the actions of the cloud hyperscalers to avoid being crushed in direct competition. Several years ago, the IoT ecosystem was largely made up of startups and smaller platform companies with revenues under $100 million. But, as adoption of IoT by large enterprises began to occur, hyperscalers saw value in entering the market. First through partnership, then through acquisition, the cloud behemoths started developing solutions to capture market share. So now the question has arrived: Will the cloud platforms wreak havoc and disintermediate smaller IoT platforms, application providers, system integrators, and network operators?

Growth of the Hyperscalers

Why are organizations moving to the cloud? There are several reasons. First, to scale costs. It takes time, investment, and expertise and few companies have money and time to invest in both organic (build it) and in-organic (buy it) growth strategies. Organizations moving to the cloud have apps and solutions based on best-of-breed technologies. They benefit from the documentation, support, and project roadmaps hyperscalers offer.

Additionally, hyperscalers are becoming de facto solution partners for IoT applications because of the demonstrable value to organizations they provide such as:

- Rapid deployment and scale: Unlike deployments of the past, organizations no longer require massive capital outlay to start projects. What’s more, scale can be achieved on demand. No more waiting for budget cycles or management approvals, or for technology to be delivered to the organization’s premises.

- Cost savings: Subscribing to a cloud platform is cheaper than purchasing, owning, and maintaining it. Trading CAPEX for OPEX means no more waiting for finance to approve large hardware or software purchases.

- Easy management: Hyperscalers handle operational management and things like patching themselves and provide limited controls through easy-to-use management consoles. This allows an organization to focus on its unique IoT application without the hardware hassle or overhead.

- Reduced downtime: By their sheer size, few companies can match the technical abilities to develop an organizational structure to maintain systems horizontally and vertically. Hyperscalers offer global redundancy and have well-balanced architectures that very rarely impact operations.

- Security and compliance: Often, hyperscalers drive R&D and participate in standards organizations. This puts them at the forefront of security and compliance discussions, so their architectures meet or exceed most major industry requirements. This lessens the burden of meeting stringent regulations for organizations.

The cloud is essential for the growth and development of IoT solutions. The increased operational efficacy, rising demand of intelligent and connected devices, and cost-effective and easily deployable cloud storage in secure environments are some of the major advantages driving the IoT cloud platform market globally.

Additionally, there are an increasing number of deployments of private LTE and 5G networks around the globe. Increasingly it is the partnerships between cloud giants and tier-one telcos that are facilitating such infrastructures. These joint solutions have extended traction because many enterprises require private network suppliers to demonstrate integration with their existing cloud platforms before they will buy.

Not wanting to compete with the hyperscalers, non-hyperscaler vendors are increasingly focusing on their core competencies. Telcos are focusing on SIM management and network control, operational technology providers are focusing on backend services, while more vertical specific application providers are focusing on purpose-built applications, services, and solutions. A big part of the cloud hyperscalers’ success is their massive investments in IoT, which have yielded dozens of new value-creating products and services for IoT end users over recent years.

Still, not all cloud platforms are created equal. While they offer similar baseline functionality, the platforms have carved out strategic niches for themselves, which render them better suited to some industries and use cases than others.

The White Horse

Microsoft’s Azure IoT Hub reached GA status February 2016. Azure IoT Suite provides features like: easy device registry, rich integration(SAP, Salesforce, Oracle, WebSphere, among others), dashboards and visualization, and real-time streaming. While AWS’ offerings are expansive, they are not yet as specialized as Microsoft Azure, particularly regarding applications for manufacturing.

The main features of Azure IoT Hub include:

- Secure communications by using per-device security credentials and access control;

- Multiple device-to-cloud and cloud-to-device hyper-scale communication options;

- Query-able storage of per-device state information and meta-data; and

- Easy device connectivity with device libraries for the most popular languages and platforms.

Additional optional features are:

- Cloud-to-device messaging,

- Device twins, and

- Device management.

Pros – Offers third-party services, high availability, secure and scalable. What’s more, Azure IoT provides you with the ability to create a custom protocol using Azure IoT protocol Gateway, which serves as middleware between device and hub.

Cons – Expensive, requires management, no direct support for bugs.

The Red Horse

AWS was the first major platform to introduce public cloud service in 2006. However, it only began adding IoT-specific services with AWS IoT Core platform December 2015. Over the years, Amazon has made it much easier for developers to collect data from sensors and Internet-connected devices. Most prominently, AWS is known for the multitude of its offerings, with a total of 227 different cloud services. This is because AWS’ business model is most oriented toward application management/enablement, rather than device management or data management/enablement. It is also known for its ease-of-use and flexibility compared to other platforms, as attention has been paid to making setup as intuitive as possible, and tutorials are openly offered by AWS.

The main features of the AWS IoT platform are: Secure gateway for devices, authentication and encryption, and device shadow.

Pros–- Open and flexible, tight integration with laaS offering, price has dropped over the last six years.

Cons – Three outages in the last three years, not as secure for hosting critical enterprise applications.

The Black Horse

The IBM Watson IoT Cloud Platform is a fully managed, cloud-hosted service with capabilities for device registration, connectivity, control, rapid visualization and data storage. Watson is a smart and scalable platform that allows users to capture and analyze user, machine, and system-generated data, including speech, text, video, traffic, noise, and social sentiment.

The Watson IoT Cloud Platform helps identify valuable insights related to device behavior and operations in the field. The pricing works on three main metrics:

- Data exchanged

- Data analyzed

- Edge data analyzed.

Unlike the IoT platforms from the other hyperscalers, Watson is designed for the development of custom solutions by large enterprise customers. Azure and AWS have been designed for companies that need a cloud-hosted back-end solution to quickly, easily, and securely connect IoT applications and devices. Conversely, Watson was built for enterprise developers searching for a cloud-hosted solution designed for device registration, connectivity, control, rapid visualization and data storage. Even though Watson has created a library of vertical use cases, it lacks the breadth of tools and plug-and-play sub-products desired by SMBs.

Pros – Industry-Leading AI, ability to ingest information in both static and dynamic format, and seamlessly integrates with Maximo.

Cons – Few plug-and-play applications, lack of developer ecosystem, longer time for integration, high maintenance, costly to switch.

The Pale Horse

Google launched Cloud IoT Core in May 2017 with the support of NXP, targeting smart city and enterprise deployments like utilities and transportation. Like Microsoft, Google also has its own IoT operating system (based on Android). Google’s end-to-end platform for IoT solutions enables organizations to easily connect, store, and manage IoT data. Google's IoT cloud platform is efficient and scalable, offers elastic storage, is fully protected, and includes data analysis tools. Google’s focus is on making things easy and fast to help scale IoT solutions. Pricing on Google Cloud is done on a per-minute basis, which is cheaper than other platforms.

Pros – Lesser access time, fastest input/output, and provides integration with other Google services.

Cons – Limited programming language choices and most of the components are Google technologies.

Note:

Since authoring this strategic insight, Google announced that it will shut down its IoT Core service next year, giving customers a year to move to a partner to manage their IoT devices. The announcement appeared with little fanfare on the IoT Core web page and in an email to customers.

While competitors like AWS and Microsoft have been able to offer services that provide a way for customers to manage their IoT devices while ingesting and normalizing data streams, we believe that Google struggled to find a workable business model to scale their IoT business and instead is moving to a model where partners that specialize in IoT applications manage the IoT process for customers.

By shifting to a partner-led model, Google will still get the benefit of revenue from data on the Google cloud platform without the heavy investment of full IoT platform development.

Non-hyperscale Platforms

Companies like PTC, Cisco, and SAP that entered the IoT platform market earlier than the hyperscalers have realized they needed to partner with (rather than compete with) the cloud hyperscalers to stay relevant.

Application providers like Motive and Samsara rely on the cloud to provide scale to their clients with real-time visibility into production facility operations, GPS fleet tracking, equipment monitoring, and more by monitoring and reporting on IoT-derived data.

Regional Considerations

Ex-China, North America currently dominates the IoT cloud platform market, and this trend is expected to continue for the next several years. This is due to robust cloud structure, an expanding number of associated devices, progress in computerized reasoning, and AI advancements in the region.

Recently, the European Commission has been voicing concern about the market dominance of the hyperscalers. That warning came with the publication of the preliminary results of the European Commission IoT competition probe.

Margrethe Vestager, vice-president at the European Commission said, “When we launched this sector inquiry, we were concerned that there might be a risk of gatekeepers emerging in this sector.”

Final Thoughts

To enhance their market position in the global IoT cloud platform market, in addition to organic product development initiatives the key players are now focusing on several diverse strategies, including M&A, joint venture creation, as well as loose collaborations and formal partnerships.

As challenging as these platform swings will be, the four horsemen may just be the beginning of the tribulation. Many other disruptors and events are bound to happen. Stay tuned to see how the IoT cloud platform market evolves over the next few years.

Edited by

Erik Linask