I was thinking about what to write about and it occurred to me that I haven’t heard much about small cells in a while. I am not sure if I unsubscribed, or if they booted me out of the email list, but I was curious to know if the Small Cell Forum was actively engaged in integrating edge compute with small cells. A little over a decade ago, the small cell industry was a buzz of press releases, customer wins and general technological innovation being deployed by service providers serving a variety of markets.

Wondering where they are now, I went on their website to see what was being talked about and, to my delight, they had a report on the State of the Market. The report had over 100 participants that included a diverse group of service providers in terms of the 70 companies, with some overlap of interviewing multiple people from the same company.

The group broke down this way:

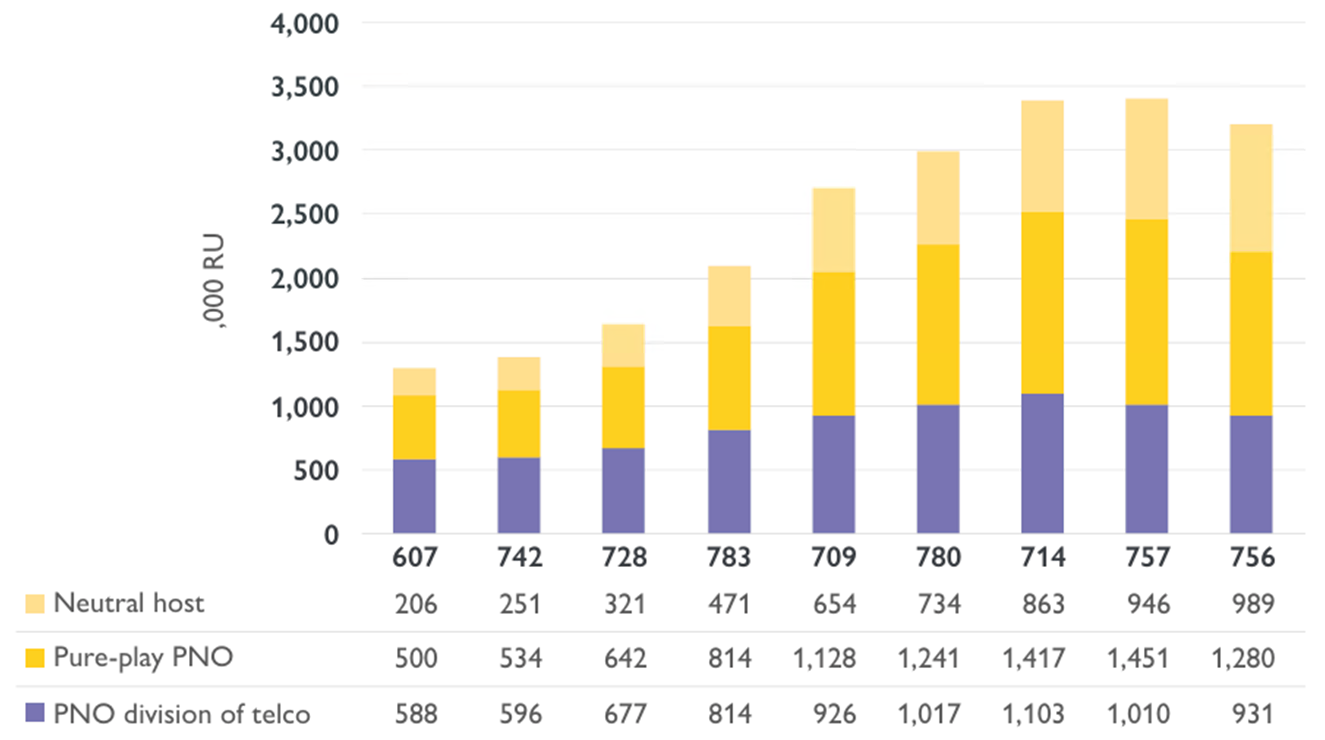

- 71 mobile-only or fixed/mobile operators, in tiers 1 and 2, from a global base,

- 23 private network operators (PNOs) and enterprise service providers, and

- 13 neutral host organizations with a strong focus on small cells, including tower operators and specialized small cell infrastructure companies.

The respondents are members of an opt-in panel that has been fairly stable since 2004. The goal is to study many aspects of cellular network deployments and business cases. All respondents are pre-qualified and typically have senior executive roles in the networks or CTO functions.

I scanned the study and was not surprised to see that the emphasis was on the network operator’s perspective. It was logical that the small cell makers would want to know their customer base. However, the questions were for an existing customer base and did not really explore the question, if you merge small cells with edge compute, do you expand the market opportunities?

I believe you do and, for that reason, I wanted more. However, it could be that we had an innovators dilemma on our hands, where the tried and true were myopic about the opportunities with small cells.

Mind you, just because the report is understated does not mean it does not cover the opportunities. Here is what the report says.

“Similar benefits can be derived when the small cell network is tightly integrated with a localized, enterprise-specific packet core, and when this is also deployed, alongside the RAN functions, on the same edge cloud.

There are different deployment and ownership models for these converged systems. An MNO may distribute the user plane functions of the core to enterprise or urban sites, for instance, while a PNO could deploy a standalone core on premise or in the public cloud. Edge compute may support both the core and the RAN functions, if the latter are virtualized, and may be built by the same operator as the RAN, or a third party such as a hyperscaler. This flexibility means deployers can select the best approach for a given scenario and maximize the efficiencies of collocated or converged domains, and the new edge/5G use cases that can be enabled and monetized.”

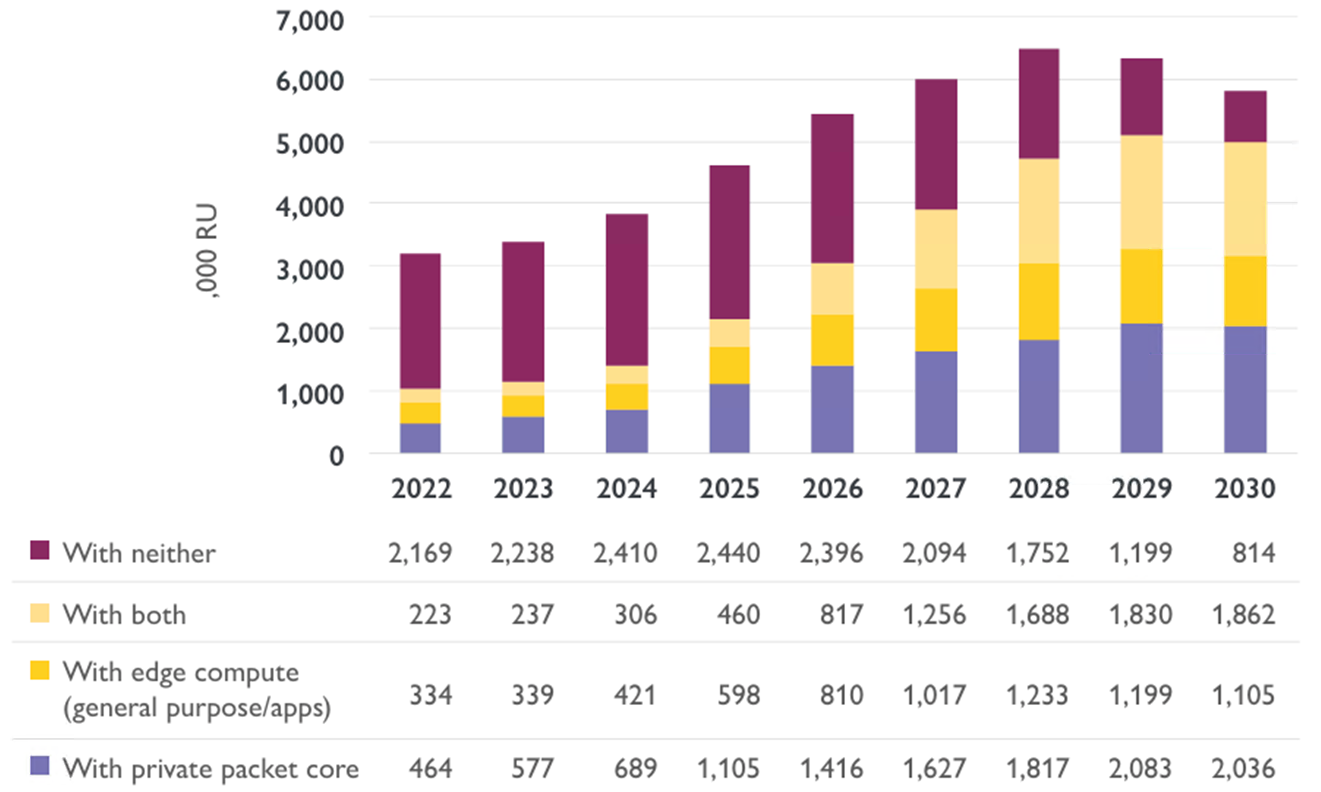

“…The rising trend for small cells, in all environments, to be collocated with core and/or edge. In 2022, 68% of small cells were not integrated with either domain, but in 2030, that will be true of only 14%. Meanwhile there will be a 30.4% CAGR in small cells deployed with both edge and core, reaching 32% of the total in 2030.

“This convergence of edge, RAN and core will be driven by the virtualization of the RAN and in particular by Open RAN, which is drawing cloud providers, such as hyperscalers, more deeply into the mobile networks space, and which encourages deployment of network functions on open or third-party cloud infrastructure, rather than in closed vendor stacks. The opening up of the RAN, together with the convergence with edge cloud and AI, will not only enable new services and monetization options, but will help to encourage growth of some of the non-traditional deployment and operating models described in Section 4-1.

For instance, Open RAN architectures that are converged with edge cloud lend themselves to shared or neutral host models in which resources can be allocated to different service providers, enterprises or applications in a flexible way, and different tenants can create distinct service profiles while using SCF 050.10.08 5 common infrastructure.

For this reason, the rise in non-MNO small cell models, the most markedly neutral host, will be more pronounced in Open RAN environments than in the market in general. Neutral hosts accounted for 22% of Open RAN cells in 2022 and this will rise to 41% in 2030, whereas across all enterprise small cell networks, the figures were 6% and 17%, respectively. The CAGR in neutral host deployments of Open RAN small cells will be 92.6%, compared to 22% in enterprise networks overall.”

These few paragraphs about enterprise deployments might help explain the myopia.

However, the tone of paper seemed to bury the innovation happening around them. Maybe there is another study not for publication except for members that looks at the enterprise perspective, but it was clear to me that part was missing from this report.

In some ways, this was understandable, as the report was helping service providers understand why demand had slowed.

“The early years of enterprise small cell deployment have been heavily driven, in terms of numbers, by large projects in heavy industries that have challenging data traffic and reliability requirements as well as large, multi-building sites. The largest number of cells were deployed in the manufacturing sector in 2022, followed by energy utilities and then by transportation hubs and various government departments.”

“By 2030, manufacturing will still be the leading sector, followed by transportation, but local government (including government-controlled smart city platforms and public safety networks) will have leapt into third place, followed by retail. The fastest growing sector in terms of units deployed throughout the period will be entertainment and media, including large venues and the content creation segment, both of which will require very dense networks and immersive experiences.

Those fastest growing sectors seem to me exactly the same as Edge Compute growth sectors. While the report shows the trend, it doesn’t show how to capture the market. It only shares that convergence will happen (and it seems regardless of how the Vendors move forward.

This doesn’t mean that all small cell companies are waiting for the future to run them over. Here are some of the efforts to move in the right direction.

- EdgeQ and WNC Collaboration: EdgeQ has partnered with Wistron NeWeb Corporation (WNC) to develop the LAS1 small cell, a software-defined, multi-mode 4G/5G solution. This compact unit integrates compute, connectivity, and cloud functionalities, achieving up to 5 Gbps throughput. It combines the Radio Unit (RU), Distributed Unit (DU), and Central Unit (CU) into a single chip, supporting both gNodeB and O-RAN applications. The architecture is designed for scalability and is field-upgradable via software, facilitating frictionless deployment across various environments. (EdgeQ, edgeir.com)

- ADLINK's 5G Small Cell Solution: ADLINK offers a 5G small cell solution that integrates with 5G terminal devices to provide low latency and high-speed communication. The solution combines ADLINK's edge server series with Intel® Xeon® processors and the SageRAN 5G RAN protocol stack, delivering a complete 5G network solution. It supports the 5G system architecture defined by 3GPP R15 and is capable of integrating with other nodes connected to 5G NR independent networking base station systems and terminals. (Intel)

- Corning's Small Cell Service Node: Corning's Small Cell Service Node is central to its Enterprise RAN (E-RAN) wireless solution, facilitating easy deployment and management of small cells. It offers functionalities such as plug-and-play provisioning, self-configuration, and self-optimization of radio parameters. The node supports integration with enterprise intranets and provides an integrated platform for mobile edge computing, making it suitable for medium-to-large enterprises and venues. (Corning, Corning)

Now it may be that the State of the Market report wasn’t built for me, because the Small Cell Forum reports that edge computing and small cell technologies is gaining traction, especially in enterprise and industrial networks. According to the Small Cell Forum, by 2026, 75% of indoor small cells are expected to be deployed with either edge computing capabilities or a private core, with around one-third utilizing both. This trend underscores the growing importance of localized processing power in enhancing network performance and enabling new services. (Small Cell Forum)

Use cases for these integrated solutions include:

- Private Cellular Networks: Enterprises can deploy private networks with integrated edge computing to ensure data sovereignty and tailor network performance to specific applications.

- Smart Cities: Municipalities can leverage these solutions for applications like traffic management, public safety, and environmental monitoring, benefiting from real-time data processing and reduced latency.

- Industrial Automation: Manufacturing facilities can utilize integrated edge and small cell solutions to support automation, predictive maintenance, and real-time analytics, enhancing operational efficiency.

I am not saying the Small Cell Forum was caught off guard. Five years ago, in June 2020, SCF published a comprehensive white paper titled Edge Computing and Small Cell Networks (SCF234), which explores the benefits and deployment considerations of integrating small cells with edge computing. The paper identifies key industry segments such as automation, Industry 4.0, mission-critical services, enterprises, and public safety where this integration can offer significant commercial and operational advantages.

The document outlines three primary deployment scenarios:

- Fully Private Cellular Networks (PCNs): Standalone networks are managed entirely by enterprises.

- PCNs with Roaming Agreements: Private networks that allow roaming onto public Mobile Network Operator (MNO) networks.

- Integrated PCNs with MNO Networks: Private networks that are integrated with public MNO networks for broader connectivity.

SCF's research indicates that, by 2025, approximately 75% of new indoor small cell deployments are expected to be co-located with edge computing capabilities and/or private Evolved Packet Cores (EPCs).

My conclusion is that the Small Cell Forum means well, but needs to talk directly to enterprises, particularly the early adopters. While the SCF talks about “co-located” I would think that a common back plane is possible and dynamic based on demand.

Bottom Line, “If you build it, they will come” may have a glitch in the definition of who is “they.” And as Pogo taught us “we have met the enemy and they is we.”

Edited by

Erik Linask