A recent web-based survey of 1,000 U.S. consumers found some good news and some bad news. On the positive side, about two-thirds of respondents were either favorable or neutral about smart grids and smart meters. On the down side, fully 30 percent of respondents still were unfamiliar with the concept of smart grids, and 24 percent were uninformed about smart meters.

In addition, “The Smart Grid Consumer Survey,” conducted by Boulder, Colorado-based Pike Research (News - Alert) last fall, determined that, in many cases, the connected home capabilities made possible through smart grids and smart meters were most appealing to young, educated, high-income respondents. However, the mature respondents evinced the most interest in managing their home electricity usage—indicating a potential disconnect in the association between smart meter-enabled approaches for controlling energy use within that segment and an overall lack of willingness to engage with these approaches.

“The survey data indicates we are still in the early phase of consumer awareness and adoption of smart grid technologies, and consumers’ understanding of the benefits that can be derived from these technologies remains relatively low,” explained Pike Senior Research Analyst Neil Strother. “Utilities and other smart grid stakeholders must find more effective means of engaging customers with simple, affordable, and helpful energy management products and services.”

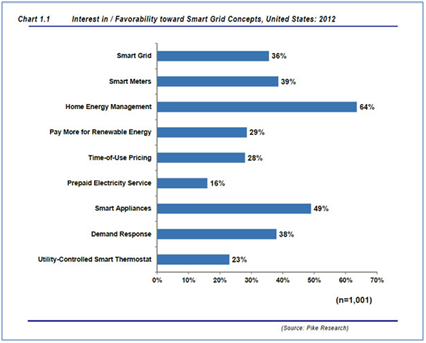

Overall, the survey found that 73 percent of consumers have concerns about the impact electricity costs have on their monthly budgets, and 63 percent are interested in managing energy used in their homes. When it comes to taking action on that interest, however, fewer than half (49 percent) are aware of companies offering home energy management services, and fewer than 40 percent have a high level of interest in participating in programs such as demand response.

Other findings included the following:

- The majority of consumers are not willing to pay a premium for renewable energy sources, suggesting that consumers are not convinced that they should support the development of these energy sources through higher bills.

- With regard to most of the topics discussed in this report, respondents who identified themselves as early adopters of technology were most interested in smart energy home technologies. However, it is not altogether clear that their adoption strategies correlate positively with a desire to manage their energy consumption.

- Less than one-third of the survey respondents showed a strong interest in time-of-use (TOU) pricing, and fewer than 40 percent were extremely likely or somewhat likely to consider a demand response (DR) program. While TOU is not a technology per se, interest in TOU pricing nevertheless decreases steadily as respondents identify themselves as less willing to adopt new technologies.

Pike predicts that utilities and other stakeholders in the sector will continue to struggle with how to most effectively engage consumers in managing their energy use. Models for how to best do this are just beginning to be established and proven out, but it is still early in the adoption cycle for many of the approaches that utilities need consumers to embrace to achieve desired energy and capacity savings.

The report analyzes the dynamics of consumer demand, preferences, and attitudes toward several key smart grid product and service categories: smart grids and smart meters, home energy management, time-of-use pricing, renewable energy, prepaid electricity services, smart appliances, and demand response.

Want to learn more about the latest in communications and technology? Then be sure to attend ITEXPO Miami 2013, Jan 29- Feb. 1 in Miami, Florida. Stay in touch with everything happening at ITEXPO (News - Alert). Follow us on Twitter.

Edited by

Brooke Neuman