If you’ve ever spent much time at a car dealership, (and I have, as my brother was manager for one of the nation’s leading auto groups) you begin to get a sense of how they truly operate. You start to learn their secrets of making money, of their vulnerabilities, and the things they want to hide.

The term connected car generally conjures up visions of self-driving and self-communicating automobiles, like the fictional Kitt from the 80’s television program Night Rider, or George Jetson’s flying car, which deposits his kids at school and his wife at the mall through pods that drop from the vehicle. But a different kind of connected vehicle exists for automobile sales organizations that many know nothing about.

While most consumers have heard of things such as GM’s OnStar, Hyundai’s BlueLink, or some of the other OEM connected car programs, many auto dealers are utilizing machine-to-machine communication for another purpose. The financial crisis of the late 2000’s hurt more than the housing market; the credit crunch impacted the automotive industry dramatically as available capital to finance vehicle sales dried up. One solution for the credit challenged that emerged is buy-here-pay-here automotive financing. BHPH is a solution for people who are in need of a car, but have difficulty getting approved for conventional financing.

BHPH allows an individual to pay a small amount as a down payment, drive away with the car, and return to the dealership each week to make payments. Basically, the dealer acts as the bank and assumes risk. To assume risk, these dealerships have turned to technology partners that offer solutions that connect, track, and control the vehicle remotely. These solutions help the dealer to assess risk; provide payment reminders (such as in-vehicle buzzers or announcements that a payment is due); and view critical vehicle data, such as location, state, and loan payment status on a single screen. What’s more, if a buyer defaults, dealers can easily pinpoint the vehicle’s location, disable the ignition, and secure the vehicle.

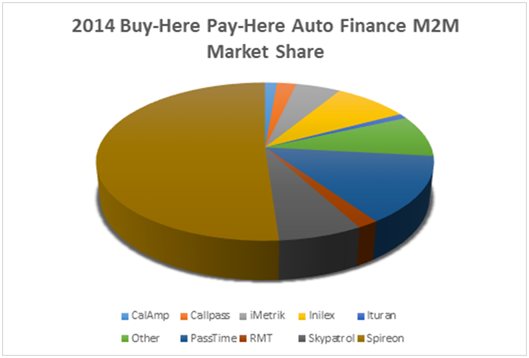

The ecosystem of technology organizations supporting the BHPH market is made up of companies big and small. While it takes hardware to connect the vehicle, software that integrates back-end dealership office systems with tracking solutions is a key component. Several companies have specialized in this market over the past decade. And while we believe that market size of the buy-here-pay-here space is somewhere north of 2 million vehicles, several companies, such as CalAmp, CallPass, Inilex, and SkyPatrol have successfully been able to capture from the tens to the hundreds of thousands of BHPH connections. An industry behemoth, Spireon, leads the overall market with well over a million buy-here-pay-here connections.

The credit challenged see BHPH as a real solution. For this reason, we believe the market will grow at a compound annual rate in excess of 30 percent for the remainder of the decade. So with the demand for subprime and collateral backed loans increasing, we believe the number of automobile dealers that will turn to technology and utilize GPS and collateral management solutions is set for an enormous rise. The greatest risk for a lender is the complete loss of collateral. But by utilizing machine-to-machine-based GPS and CMS systems, BHPH dealers are protected.

Our research has shown that over the last two years, 25 percent of all auto loans were subprime. A growing number of these are collateralized notes. With delinquencies on the rise, the NABD recently released a survey stating that 74 percent of financers said that using an M2M-based automotive GPS and CMS solution with integrated payment reminders reduced delinquency rates by more than 10 percent. This helps the dealer protect inventory, helps the subprime customer in having a tool to help repair his credit, assists the financer in closing more loans, helps towing companies in the repossession process, and encourages customers in making payments, which results in the lender receiving timely loan payments.

While this has been one of the automotive industry’s hidden secrets, we believe the practice could easily be grown to benefit mainstream dealerships and traditional lenders. Today, the BHPH industry accounts for approximately 6 percent of all cellular connections, and we believe that, with the growth we expect, 6 percent is far too great a number to be overlooked moving forward.

Edited by

Maurice Nagle