The global transportation market is the largest vertical market within the machine-to-machine and Internet of Things movement. But what is connected transportation? Does it have to do with tracking the transportation of goods via land, sea, or air? Does it have to do with safety and security applications like OnStar? What about connecting fleets?

Market Size

We at James Brehm & Associates estimate the current transportation market is worth more than $4.5 trillion dollars and is growing. And the use of M2M in transportation will continue to develop rapidly as the industry matures.

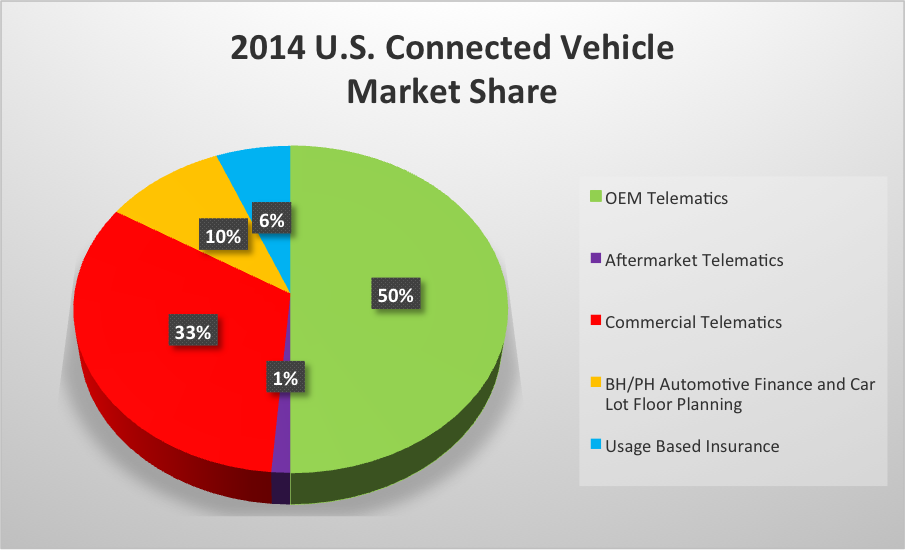

The industry is booming due to the increasing number of vehicles on the road. In the United States, there are currently more than 339 million vehicles today. But currently less than 8 percent of passenger vehicles and 20 percent of fleet vehicles are connected, leaving a long-tail of opportunity for OEMs and aftermarket companies alike.

The Connected Car

The connected car is the biggest piece of the pie in transportation and is quickly evolving and transforming the transportation industry.

Connected cars are becoming smarter and more widely connected than ever because of the use of M2M solutions. The connected car industry is set to grow seven-fold by 2018, according to the GSMA. James Brehm & Associates believes that by 2020, more than 90 percent of new vehicles sold will be connected.

A market dominated by OnStar, the connected car space has since greatly expanded, with nearly every auto OEM having defined and announced strategy on this front.

Vehicles are expected to be connected either by embedded solutions, smartphone integrations, or a combination of both. OEMs are using embedded solutions to provide a single platform to enhance customer service, provide proactive maintenance, improve quality and efficiency, and build new business models.

New revenue streams and service models are emerging as a result of embedded and smartphone-integrated solutions. These new business models are being created as OEMs learn how to utilize connectivity and exploit telemetry data collected, and by offering new services to customers. For example, auto manufacturers could sell leads for service, warranty, or recall work to individual dealerships.

Fleet Solutions

Fleet management solutions utilize M2M to manage vehicle performance and maintenance, optimizing route efficiencies, and to help companies adhere to regulations. Fleet management systems use these solutions to help determine the location of the vehicle, and whether it is being used in the most effective and efficient manner.

Today, fleet solutions make up one of the largest segments in all of M2M, yet less than 20 percent of fleets are currently connected. With the growth of delivery and other SMB fleets, and with the federal government’s push to have over-the-road drivers utilize electronic log books, tremendous upside exists in this space.

Companies in the fleet business are able to utilize M2M solutions to help create strategies that enable them to have a positive impact on their bottom lines. Besides knowing where vehicles are located, companies can also access a number of metrics that can help determine whether they are using vehicles in the most efficient manner. For example, are drivers using the most optimized route or are they driving too fast, causing an increase in fuel costs?

Aftermarket Solutions

Aftermarket solutions are growing and changing the ways people interact with their vehicles. From simple track and trace solutions to more complex remote-start offerings, aftermarket OBDII (on-board diagnostics port type 2) connections or Internet gateways may be directly wired into vehicles for a variety of purposes.

Over the past few years, companies such as AudioVox and Denso that traditionally supplied aftermarket auto products have entered the aftermarket M2M space. With AudioVox Car Connection, automobile owners can monitor vehicle health, location, driver behavior, speed, fuel consumption, and efficiency. What’s more, with remote-start capabilities, users can start the vehicle and control the in-vehicle climate before they get in.

Another aftermarket example comes in the rental space. Rental car giant Hertz is including solutions that allow companies to advertise their products and services to renters. From restaurants to hotels to gas stations, this could provide a new revenue stream for Hertz.

Usage-Based Insurance

While UBI has been around for years, many people still don’t understand the concept, and many insurers are still trying to grasp advantages and create differentiation through unique business models.

UBI is a form of insuring a vehicle (and driver) where the costs are dependent upon such metrics as driver behavior, time of day, distance driven, location, make and model of vehicle, acceleration and deceleration, and other factors.

Auto Financing

Perhaps one of the largest but most misunderstood markets in all of M2M is the BHPH space.

The financial crisis of the late 2000’s hurt more than the housing market. The credit crunch impacted the automotive industry and one solution for the credit challenged that emerged is buy-here-pay-here dealerships. BHPH dealerships are a solution for people who are in need of a car but are having difficulty getting approved for conventional financing. They allow an individual to pay a small amount down and make regular payments onsite. Basically, the dealer becomes the bank and absorbs the risk.

To absorb risk, these dealers have turned to technology. By connecting a tracking and control device in the vehicle, dealers can view through an online dashboard all of the critical vehicle data such as location, state, and loan payment status on a single screen. If the buyer defaults, the dealership can easily disable the ignition, pinpoint location, and secure the vehicle.

Public Transportation

The public transportation sector has evolved to meet the needs of its passengers and is utilizing M2M solutions to gather telemetry information, become more efficient in delivery of services to passengers, provide riders with access to Wi-Fi, and place advertisements both inside and on the exteriors of buses and trains via digital signage solutions.

Additionally, many entities that operate bus fleets and trains now offer cashless transaction systems. That can help improve business efficiencies and offer real-time access to customer data.

Keep on Truckin’

These are just some of the things I think about when I hear the words connected transportation, but many more exist.

Overall, the transportation industry continues to evolve as a result of the use of M2M solutions. While every sector has different needs within this industry, the benefits of utilizing M2M solutions are dramatically changing how the transportation industry operates. It will be interesting to see how next generation business models impact the way consumers interact with transportation.

For example:

• How will Zipcar, Carma, Car2Go, and other ridesharing companies significantly impact the need for an individual car?

• How will companies like Uber or Lyft, that are built around smart applications and ubiquitous smartphones, impact the livery business?

• And, will public transportation become subsidized by in-vehicle advertising and on-vehicle digital signage?

The use of fleet management technologies has definitely made companies like UPS and FedEx more reliable. But will drones and self-driving vehicles render the UPS man obsolete?

Edited by

Maurice Nagle