Click here to read part 1: Low Power WAN Technologies for IoT: Build, Buy or Partner?

Apples to Apples Comparisons Criteria

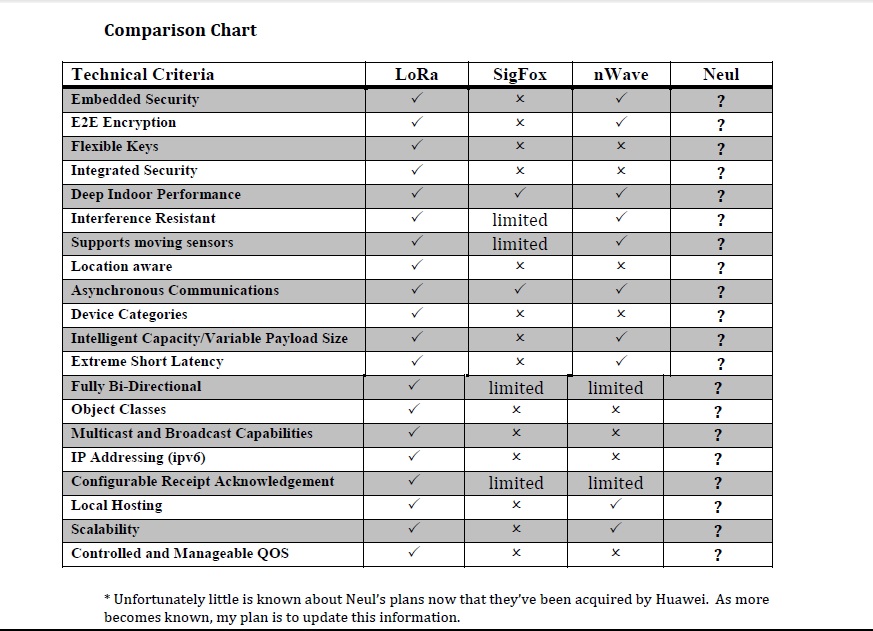

When selecting the LPWAN strategy several aspects need to be taken into account. Below I have listed the ones that I believe should be considered and compared to optimize the addressable market and ensure an optimal choice for now and in the future.

TECHNOLOGY:

Security

- Embedded identification and authentication which guarantees security, making it virtually impossible to interfere with the data transmission

- End to End Encryption ensuring optimal confidentiality of the data transmission and data integrity in both uplink and downlink.

- Flexible management of security keys embedded at the manufacturing level or remotely upon initial use of the network by the sensors.

- Integrated Security, preferably in the MAC layer, to vastly reduce the complexity at the application layer. This systematic type of security also avoids potential breaches and should not compromise the flexible payload of each message.

Advanced Radio Technology

- Performing outdoor, indoor and deep indoor due to extreme attenuation (link budget) enabling use cases in all three domains.

- Interference resistant even in environments which are typically not optimal for radio signals due to noise. In the end the packet loss rate, mainly impacted by the local noise floor and interferers or collision will determine the achievable Quality of Service.

- Supports stationary or moving sensors to enable data transmission when driving or otherwise moving.

- Location determination enablement for indoor or outdoor use cases cannot be neglected as it drives many use cases. A potential strong differentiator is the ability to track sensors without the need of an embedded GPS module as this drives up both the material cost and power consumption substantially.

Low energy consumption

- Asynchronous communication reducing the power consumption to an absolute minimum.

- Device categories in classes enabling use cases for ‘send and respond,’ ‘listen regularly,’ or ‘always on’ allowing for subscription differentiation, thereby an important tool to maximize revenues and increase ARPU.

- Intelligent and automatic capacity allocation is required to reduce/increase data rate depending on the quality of the signal and the attenuation. A dynamically allocated data rate depending on distance, sensitivity and local noise/interference levels is crucial. This provides spectrum optimization (and cost benefits), reliability, and scalability, crucial in dense urban applications.

- Extreme short latency for full bi-directional message handling equal or better than text messaging allowing for instant response applications or use cases.

COMMERCIAL CRITERIA

In order to have the most commercial impact, adaptability to different use cases is crucial. In cases where all of these criteria are not met, then the addressable markets become more limited.

In addition to the technological criteria above, to follow are many of the features required to handle the highest number of use cases:

- Full bidirectional technology to support any use cases and enable Over the Air (OTA) upgrades of service when required (rather than one way or limited two way communications).

- Variable Payload size driven by the actual needs of the application (rather than fixed payload).

- Object classes to differentiate between uplink only, uplink and respond, or always on type of use cases driven by the demand of balancing solution versus power consumption and cost.

- Multicast and Broadcast features to reach groups of sensors in the most efficient way.

- Configurable acknowledgement of receipt to ensure mission critical data is received by either the network or the sensor.

- Local Hosting is often a prerequisite due to local legislation and privacy constraints. Central cloud outside of any country of origin can be prohibitive to some use cases.

- Ability to handle scalability needs to be embedded in the design thus allowing for gradual load and growth of the network capacity as market demand increases.

- Controlled and manageable Quality of Service using clear packet loss rate analysis for example through frame counter numbering. Maintenance of existing base stations, or adding new ones, should not impact the quality of service due to the networks intelligence handling automatically the required adjustments.

Legal and Financial

Once the technical prerequisites and market demands can be met, there are the contractually binding financial and legal aspects that need to be considered while working with the supplier of choice. As the IoT is at the top of its hype-cycle, according to Gartner, and loads of entrepreneurial and small companies are entering the market many challenging financial and prohibitive contractual frameworks are being proposed.

CRUCIAL CONTRACTUAL TERMS AND CONDITIONS

- Revenue sharing is a method to ‘pay as you use’ the technology of choice. Typically Network Operators are financially capable to invest in upfront licensing and do sometimes accept sharing the generated revenue. In any case a mandatory sharing of substantial parts of the revenue will be a showstopper as the Servcie Provider takes the majority of the risk and the investment in the roll out and management of the network.

- Market Pricing for connectivity or so called subscriptions is a network owner responsibility. As such it is up to the network owner to define the optimal pricing model to capture sufficient market share for an acceptable return on investment.

Upfront exclusivity fees are limiting the funds available for market development and sales. Moreover the IoT can be best characterized as collaborative and open source where possible.

- Base station and network server (OSS/BSS) sourcing can be determining factors as proprietary elements and single sourcing eliminate competitiveness and create continuity challenges.

- Use of existing telecom infrastructure is an important cost saving when deploying any network, certainly when one can benefit from existing backbone for backhaul purposes. Also economies of scale can be achieved through combined efforts for maintenance and network supervision. The crucial factor here is clearly the coexistence of the LPWA technology with 3G, 4G and LTE.

- Supplier size and stability are important factors given the long term commitments required to justify the investments. As the market is characterized by slow ramp up, the revenue streams will grow alike and some providers may disappear or merge with a competitor creating unnecessary complexities in the future.

- Roll out commitment is forced by the technology supplier in some cases. In fact this is the world upside down as market demand should drive the network coverage and justify enhanced territory or population coverage.

- Operating frequency for public LPWA networks is often in the ISM band today. On the longer run it will proof beneficial if the technology of choice, and related sensors, can also operate in licensed bands as this may well be required.

- Ownership of the network and the contracted customers should reside with the Service Provider deploying the network and not be limited in terms of time nor territory.

- Licensing terms for using the LPWA Network IP need to be perpetual and not limited in time. Any restriction on term, territory, pricing freedom and international client acquisition increases the risk for the MNO and limits the overall and long term value for its stakeholders.

Build, Buy or Partner Considerations

As the market rapidly progresses there are multiple models that are emerging:

Network providers and Startups are signing as market exclusive partners with SigFox (who has been backed by several MNOs). To date, however, the network partners have primarily not been MNOs and the actual user base is at bestin the hundreds of thousands connected devices.

nWave’s typical market is private networks for smart city projects and other project based deployments, but are also targeting partnerships with MNOs and have recently announced a smart city inititive in Denmark.

MNOs are rolling out and operating their own networks, primarily based on LoRa, as evidenced by recent announcements by SK Telekom (interestingly also an investor in SigFox), Proximus, Swisscom, Bouygues and KPN. As millions of LoRa sensors are already in use around the world and hundreds of eco system partners develop sensors and LoRa centric solutions, Semtech is clearly in the lead position.

MNOs are partnering with new market entrants (in some cases MNO backed) based on either LoRa or Weightless.

Some startups are also entering the game deploying end-to-end networks of their own, notably Senet in the USA, deploying LoRa for both its own tank monitoring business and as a public network for other partners, resellers and MNOs. No doubt others will follow.

The activities in each of these areas are too numerous to mention here as new developments and entrants are happening weekly, all one needs to do is watch the news releases, Linked IN, or the web sites of SigFox, the LoRa Alliance, and Weightless.org.

As an example, just this week Weightless announced a partnership with Taiwanese provider M2Comm to develop Weightless-P for a more advanced and robust, 2-way LPWAN protocol to be released early next year.

CONCLUSIONS

Firstly, there is lots of conflicting information about these technologies as each group is proliferating their own views on themselves and in some cases refuting the others’ and as such it is important to note that this piece is meant to put the facts on the table as investigated by and reported to me, and used as a basis for deeper investigation. As with all new technologies, real world comparisons will become apparent as the networks themselves evolve and head to head benchmarking data becomes more widely known. While LoRa appears to be the most fully formed and flexible technology to date with the largest ecosystem, I don’t believe that this is a “VHS vs Betamax” story and that each of these technologies will find their place and use cases in the market, especially with such heavy weight and investments thrown behind all of them. The real questions always comes down to the reality of the ‘billions’ of IoT devices and the monetization, financial viability and use cases of that story. We’ve lived through the long tail of Machine to Machine, and what a long tail it has been, and as such we have started to see some real market value created. IoT is a new story, or at least a continuation of the old one, and certainly more money has been spent than made on one side, while on the other the promise of real socio-economic value seems both reasonable and attainable, but only through these new technologies and continued investment in them as well as open and honest collaboration and “coopetition”, as it were. I, for one, am watching with keen interest!

Dan McDuffie is the former CEO of Wyless, a leading IoT Managed Services provider and today is a strategy consultant on M2M, IoT and Mobility for both Enterprises and Private Equity and a frequent technology writer and public speaker.

https://www.linkedin.com/in/danmcduffie Twitter: @DanBMcDuffie

Edited by

Ken Briodagh